Introduction

In today’s highly competitive manufacturing and service industries, understanding your costs is more important than ever. One of the most widely used cost accounting methods is job-order costing. Whether you’re running a manufacturing plant or a service business, learning how to track costs accurately for each job is essential for profitability, financial reporting, and strategic decision-making.

In this comprehensive guide, we will break down the job-order costing system, explain how to calculate unit product costs, and show how using tools like predetermined overhead rates and job cost sheets can boost your business’s efficiency and bottom line.

What is Job-Order Costing?

Job-order costing is a system used when many different products are produced each period, or when products are manufactured to customer order. Each job (or order) is unique, requiring the tracing or allocation of costs to that specific job and maintaining dedicated cost records.

Examples of Companies That Use Job-Order Costing

- Aircraft Manufacturing (e.g., Boeing)

- Large-Scale Construction (e.g., Bechtel International)

- Movie Production (e.g., Walt Disney Studios)

- Law Firms, Accounting Firms, and Medical Service Providers

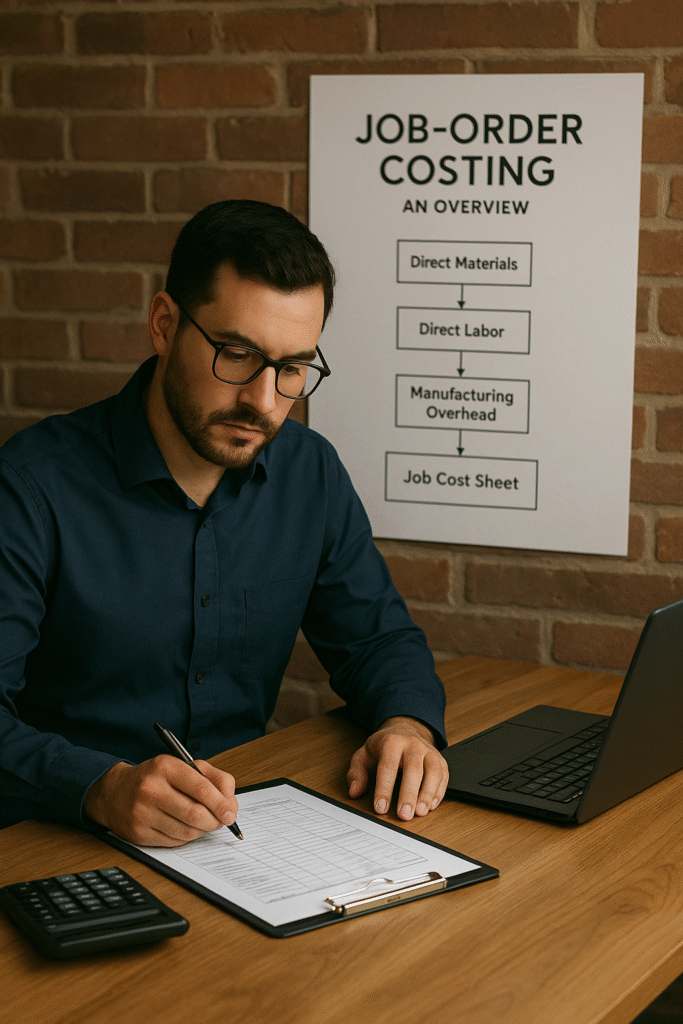

How Job-Order Costing Works: The Cost Flow

The flow of costs in a job-order costing system is centered around three major cost elements:

- Direct Materials: Materials that are traced directly to each job.

- Direct Labor: Labor hours or costs traced directly to each job.

- Manufacturing Overhead: Indirect costs (e.g., indirect materials, indirect labor, utilities) that cannot be directly traced to a job and must be allocated.

Direct vs. Indirect Costs

- Direct costs are charged directly to jobs as work is performed.

- Indirect costs (overhead) are allocated to all jobs using an allocation base.

The Job Cost Sheet: Your Costing Roadmap

A job cost sheet is the document that accumulates all costs assigned to a specific job. It helps track:

- Direct materials

- Direct labor

- Manufacturing overhead

This sheet serves as a subsidiary ledger for Work-in-Process and Finished Goods on your balance sheet.

Why Use an Allocation Base?

Since it is difficult or impossible to trace overhead costs directly to jobs, companies use an allocation base (such as direct labor hours, direct labor dollars, or machine hours) to allocate overhead. Many overhead costs are fixed, and the allocation base helps distribute these costs fairly across jobs.

The Predetermined Overhead Rate (POHR): Calculating and Applying Overhead

Because actual overhead isn’t known until the end of the period and can fluctuate, companies estimate a predetermined overhead rate (POHR) at the start of each period.

How to Compute a Predetermined Overhead Rate

The four-step process is:

1. Estimate the total amount of the allocation base required for next period’s estimated production.

2. Estimate the total fixed manufacturing overhead cost and the variable manufacturing overhead cost per unit of the allocation base.

3. Calculate the estimated total manufacturing overhead cost:

Y = a + bX Where: Y = Total estimated manufacturing overhead cost a = Estimated total fixed manufacturing overhead cost b = Estimated variable manufacturing overhead cost per unit of allocation base X = Estimated total amount of the allocation base

4. Compute the predetermined overhead rate:

POHR = Estimated total manufacturing overhead cost / Estimated total amount of allocation base

Example Calculation

Suppose PearCo estimates 160,000 direct labor-hours, $200,000 fixed overhead, and $2.75 variable overhead per labor-hour:

Y = $200,000 + ($2.75 × 160,000) = $640,000

POHR = $640,000 / 160,000 = $4.00 per direct labor-hour

Calculating Total Job and Unit Product Costs

Once you have your POHR, you can calculate the cost of any job:

Total Job Cost = Direct Materials + Direct Labor + Applied Overhead

Unit Product Cost = Total Job Cost / Number of Units Produced

Example

If Job WR53 requires $200 of direct materials, 10 direct labor hours at $15/hour, and the POHR is $38 per labor hour (based on $760,000 total overhead and 20,000 labor hours):

- Direct Labor: 10 × $15 = $150

- Applied Overhead: 10 × $38 = $380

- Total Job Cost: $200 + $150 + $380 = $730

Why Accurate Costing Matters for Managers

Accurate job costing influences key managerial decisions, from pricing to resource allocation. Job-order costing systems precisely trace direct materials and labor but can sometimes struggle with overhead allocation. Choosing the correct allocation base or even using multiple bases (cost drivers) can greatly improve cost accuracy.

Using Multiple Predetermined Overhead Rates

Some companies improve accuracy by using multiple POHRs, each based on different allocation bases in different departments (e.g., machine hours in Milling, labor hours in Assembly).

Example: Departmental Overhead Rates

- Milling: $390,000 fixed + ($2.00 × 60,000 machine hours) = $510,000

- Assembly: $500,000 fixed + ($3.75 × 80,000 labor hours) = $800,000

Apply these rates to the appropriate allocation bases for each department to compute the total job cost more accurately.

Activity-Based Costing: A Modern Approach

Activity-based costing (ABC) assigns overhead costs based on activities, leading to even more accurate job costing. ABC systems can help you understand which jobs, products, or customers consume the most overhead resources.

Reporting and Financial Statements

Job cost sheets form the backbone of key financial reports:

- Balance Sheet: Work-in-Process and Finished Goods accounts are supported by job cost sheets.

- Income Statement: Cost of Goods Sold is derived from completed job cost sheets.

Adjusting for Underapplied or Overapplied Overhead

- Underapplied Overhead: If applied overhead is less than actual, increase COGS (reduces profit).

- Overapplied Overhead: If applied is more than actual, decrease COGS (increases profit).

Job-Order Costing in Service Companies

Job-order costing isn’t just for manufacturers. Service companies like law firms, accounting practices, and hospitals use job-order costing to track costs by client, case, or procedure.

Conclusion

Job-order costing is an indispensable tool for businesses producing customized products or services. By understanding how to trace direct costs and allocate overhead accurately—whether through plantwide rates, departmental rates, or activity-based costing—you gain a powerful advantage in pricing, profitability, and decision-making.

Key Takeaways:

- Use job cost sheets to track costs accurately by job.

- Calculate a fair predetermined overhead rate to allocate indirect costs.

- Consider multiple overhead rates or ABC for higher accuracy.

- Regularly review and adjust for under/overapplied overhead.

Frequently Asked Questions (FAQ)

Q: What’s the difference between job-order costing and process costing?

A: Job-order costing is for unique or custom jobs, while process costing is for mass-produced, identical units.

Q: What are common allocation bases?

A: Direct labor hours, direct labor dollars, machine hours, or any activity that drives overhead costs.

Q: Why is activity-based costing better?

A: It tracks overhead costs more precisely by activities, leading to better decision-making.

Optimize Your Costing System Today!

Implementing a robust job-order costing system will transform the way you manage your business, giving you data-driven insights for pricing, cost control, and profitability. Start optimizing your costing strategy now for long-term success!

Looking for more guides on managerial accounting and cost control? Subscribe to our blog for updates!

References:

- Noreen, E. (6e). Chapter 3: Job-Order Costing: Calculating Unit Product Costs. PowerPoint Presentation.

This article is for educational purposes. Consult a professional accountant for specific advice.

Let me know if you want this in a different format or need images or meta descriptions for even better SEO!