Corporate finance is one of the foundations of business, investing, and economics. Every company, whether it is a small startup, a family business, or a multinational corporation, must make financial decisions every single day.

These decisions include:

- How to raise money

- How to spend money

- How to manage risk

- How to grow sustainably

Corporate finance studies how these decisions are made and how they affect the value of the firm over time.

This guide explains corporate finance in very simple language, step by step, so even someone with no background in finance can fully understand it.

Audio guide for study:

1. What Is Corporate Finance?

Corporate finance is the area of finance that focuses on how companies manage money.

It is not about bookkeeping or recording past transactions. Instead, it is about making decisions that shape the future of the company.

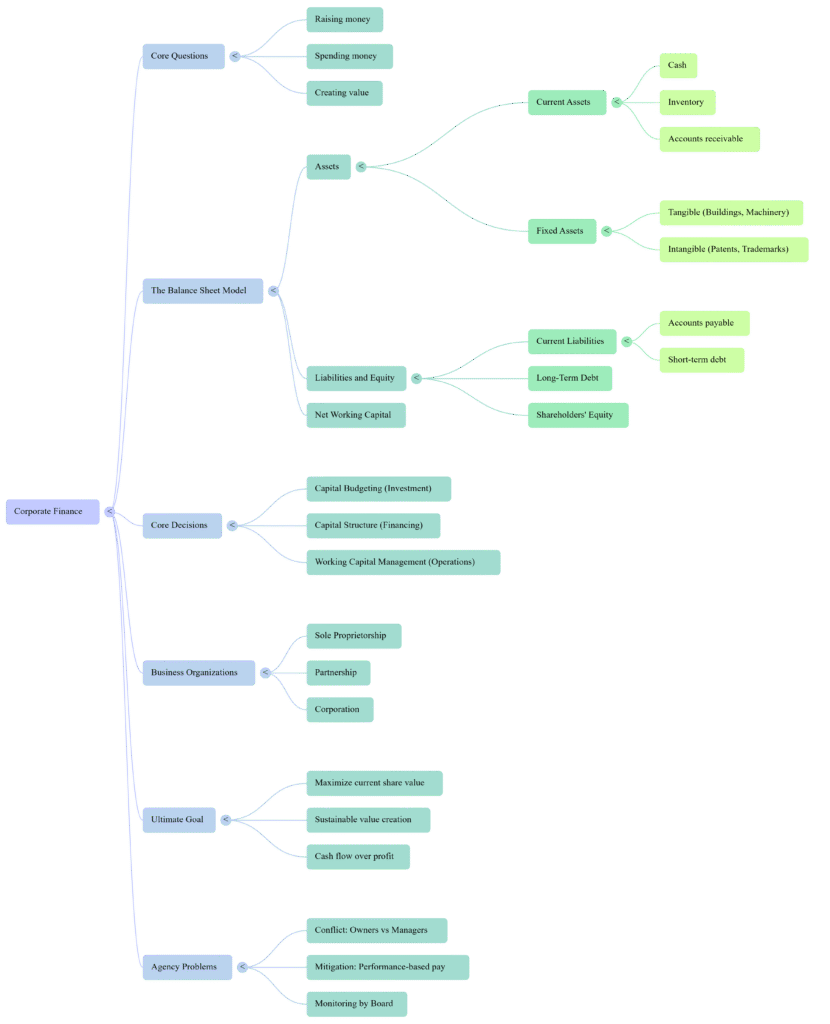

At its core, corporate finance answers three fundamental questions:

How does a company get money?

Companies raise money by:

- Borrowing (debt)

- Selling ownership (equity)

- Using profits they already earned

How does a company spend that money?

Companies spend money on:

- Equipment

- Buildings

- Employees

- New products

- Technology

- Expansion

How does a company create value for its owners?

A company creates value when it:

- Generates more cash than it uses

- Invests in profitable projects

- Uses resources efficiently

Corporate finance focuses on decision-making and value creation, not accounting rules.

The Main Goal of Corporate Finance

Every financial decision should:

- Improve the company’s long-term future

- Generate more cash than it consumes

- Increase the value of the firm over time

If a decision does not create value, corporate finance says it should not be made.

2. The Balance Sheet Model of the Firm

The balance sheet is one of the most important tools in corporate finance.

It provides a snapshot of the company at a single point in time, showing:

- What the company owns

- What the company owes

- Who owns the company

Think of the balance sheet as a financial map of the firm.

2.1 Assets: What the Company Owns

Assets are all the resources a company uses to operate and generate revenue.

Without assets, a company cannot produce goods or provide services.

Assets are divided into two main categories.

2.1.1 Current Assets

Current assets are short-term assets that are expected to turn into cash within one year.

Examples include:

- Cash

Money the company can use immediately. - Inventory

Products that are ready to be sold. - Accounts receivable

Money customers owe to the company. - Short-term investments

Temporary investments that can be converted into cash quickly.

Current assets are critical for daily operations.

Without enough current assets, even a profitable company can fail because it cannot pay its bills.

2.1.2 Fixed Assets

Fixed assets are long-term assets that support the company’s operations over many years.

There are two types of fixed assets.

Tangible Fixed Assets

These are physical assets you can see and touch:

- Buildings

- Machinery

- Equipment

- Vehicles

Intangible Fixed Assets

These have value but no physical form:

- Patents

- Trademarks

- Brand value

- Software licenses

Fixed assets allow the company to produce goods and services consistently over time, which is essential for long-term success.

3. Liabilities and Equity: How Assets Are Financed

Assets do not appear for free.

A company must raise money to acquire them.

This brings us to the right side of the balance sheet.

3.1 Liabilities (Debt)

Liabilities represent money the company must repay.

They are divided into two categories.

Current Liabilities

Short-term obligations due within one year:

- Short-term debt

- Accounts payable (money owed to suppliers)

- Taxes owed

- Wages payable

These must be carefully managed to avoid cash problems.

Long-Term Debt

Debt that does not need to be repaid within one year:

- Bank loans

- Bonds

- Mortgages

Long-term debt allows companies to finance large projects without paying everything upfront.

3.2 Shareholders’ Equity

Shareholders’ equity represents the owners’ claim on the firm.

It is called the residual value, meaning:

What remains after all debts are paid

Equity includes:

- Money invested by shareholders

- Retained earnings (profits reinvested in the business)

As the firm grows and creates value, shareholders benefit.

4. Net Working Capital

Net working capital measures the firm’s ability to meet short-term obligations.

Net Working Capital = Current Assets − Current Liabilities

Why Net Working Capital Matters

- Positive net working capital

The firm can operate smoothly and pay its bills. - Negative net working capital

The firm may struggle to survive, even if it is profitable.

Managing working capital is essential for financial stability and survival.

5. The Three Core Decisions in Corporate Finance

Corporate finance revolves around three major decisions.

5.1 Capital Budgeting: Investment Decisions

Capital budgeting answers the question:

What long-term assets should the firm invest in?

Examples include:

- Buying new equipment

- Opening a new factory

- Expanding into new countries

- Launching new products

These decisions are expensive, risky, and often irreversible.

That is why managers use financial tools to evaluate whether an investment will create value.

Key principle:

Only invest in projects that increase firm value.

5.2 Capital Structure: Financing Decisions

Capital structure refers to how a firm finances its assets.

The main options are:

- Debt

- Equity

- A mix of both

Using debt can increase returns but also increases risk.

Using equity is safer but reduces ownership concentration.

The goal is to find the optimal balance between risk and return.

5.3 Working Capital Management: Short-Term Decisions

This area focuses on day-to-day financial operations.

Key issues include:

- Timing of cash inflows and outflows

- Inventory control

- Credit policies

- Liquidity planning

Even large, profitable companies can fail if they mismanage cash.

6. The Role of the Financial Manager

The financial manager is responsible for all major financial decisions in the firm.

Key responsibilities include:

- Planning investments

- Managing financial risk

- Forecasting cash flows

- Raising capital

- Maximizing firm value

In large companies, this role is handled by the Chief Financial Officer (CFO).

7. Forms of Business Organization

Businesses can be organized in different legal forms.

7.1 Sole Proprietorship

A business owned by one person.

Advantages

- Easy to start

- Low regulation

- Owner keeps all profits

Disadvantages

- Unlimited personal liability

- Limited access to capital

- Business ends if owner leaves

7.2 Partnership

A business owned by two or more people.

Types:

- General partnerships

- Limited partnerships

Advantages

- Shared resources

- Shared management

Disadvantages

- Unlimited liability for general partners

- Difficult ownership transfer

- Limited life

7.3 Corporation

A corporation is a separate legal entity from its owners.

Key advantages

- Limited liability

- Easy ownership transfer

- Unlimited life

- Access to capital markets

Main disadvantage

- Double taxation

Because of these advantages, corporations dominate modern business.

8. Why Cash Flow Is More Important Than Profit

Corporate finance focuses on cash flows, not accounting profits.

Accounting profit can be misleading because:

- Revenue may be recorded before cash is received

- Expenses may be recorded after cash is paid

Cash flow shows the real economic impact of decisions.

Value is created only when cash actually enters the firm.

9. Timing of Cash Flows

One dollar today is worth more than one dollar tomorrow.

Reasons:

- You can invest money today

- Future cash is uncertain

- Inflation reduces value over time

Corporate finance considers both the amount and timing of cash flows.

10. Risk and Uncertainty

Future cash flows are uncertain.

Risk comes from:

- Market conditions

- Competition

- Economic cycles

- Political instability

Investors demand higher returns for taking higher risk.

Corporate finance develops tools to measure and manage risk.

11. The Ultimate Goal of Financial Management

The primary goal of financial management is:

Maximize the current value of the firm’s shares

This goal:

- Aligns management with owners

- Focuses on long-term value

- Encourages efficient use of capital

Why Corporate Finance Matters

Corporate finance is not just about numbers.

It is about:

- Decision-making

- Incentives

- Risk management

- Ethics

- Governance

- Value creation

Understanding corporate finance helps you:

- Run better businesses

- Make smarter investments

- Analyze companies effectively

- Build long-term wealth

Summary and Conclusions

What Is Corporate Finance?

Corporate finance focuses on how companies make financial decisions that increase the value of the firm.

At its core, corporate finance answers three questions:

- Capital budgeting – Which long-term investments should the firm make?

- Capital structure – How should the firm finance those investments (debt vs. equity)?

- Working capital management – How should the firm manage day-to-day finances?

The main goal of corporate finance is maximizing firm value, usually measured by the value of the company’s stock.

The Goal of Financial Management

The primary goal of financial management in a for-profit firm is:

Maximize the value of the firm’s equity (stock).

This goal helps guide decisions about investments, financing, and operations. Every financial decision should answer one key question:

Does this decision increase the value of the firm?

Forms of Business Organization

There are three basic legal forms of business:

1. Sole Proprietorship

• Owned by one person

• Easy to start

• Owner has unlimited personal liability

• Hard to raise large amounts of capital

2. Partnership

• Owned by two or more people

• Shared decision-making

• Unlimited liability for partners

• More capital than sole proprietorship, but still limited

3. Corporation

• Separate legal entity

• Owners (shareholders) have limited liability

• Easier to raise large amounts of capital

• Subject to double taxation (corporate tax + personal tax)

Most large businesses choose the corporate form because it allows easier growth and ownership transfer.

Agency Problems in Corporations

In corporations, owners (shareholders) hire managers to run the company.

An agency problem occurs when managers act in their own interest instead of shareholders’ interests.

Examples:

• Excessive executive pay

• Avoiding profitable but risky projects

• Resisting takeovers to protect management jobs

Agency problems can be reduced through:

• Performance-based compensation

• Monitoring by boards and shareholders

• Market discipline (takeovers)

Why Financial Markets Matter

Financial markets help corporations by:

• Providing access to capital

• Allowing ownership transfer

• Improving price discovery

• Increasing efficiency and transparency

Strong financial markets make corporations more valuable and efficient.

Concept Questions – Clear Answers

1. Forms of Business

Most startups choose sole proprietorship or LLCs because they are easy to form and flexible. Corporations are usually adopted later for growth.

2. Goal of Financial Management

The goal is to maximize shareholder value, not profits or revenue alone.

3. Agency Problems

Shareholders own the corporation. They control management through voting, boards, and compensation. Agency problems arise because managers do not own the firm directly.

4. Not-for-Profit Firm Goals

A not-for-profit firm should focus on:

• Service quality

• Financial sustainability

• Efficient use of resources

• Mission fulfillment

5. Short-Term vs Long-Term Focus

Focusing only on short-term stock price can harm long-term value. Managers should prioritize sustainable value creation.

6. Ethics and Firm Goals

Maximizing firm value does not require unethical behavior. In the long run, ethical behavior supports trust, reputation, and profitability.

7. International Financial Management

The goal remains the same worldwide: maximize firm value. Differences arise due to taxes, laws, and market structures.

8. Hostile Takeover Scenario

If management blocks a takeover offering a higher price without justification, they may not be acting in shareholders’ best interests.

9. Ownership Structure and Agency Problems

Agency problems may differ across countries. Concentrated ownership (banks or institutions) can reduce some agency issues but create others.

10. Executive Compensation

High executive pay is justified only if it reflects value creation. Compensation should align incentives with shareholder interests.